Your Property Choices Today Can Massively Impact Your Profits 4-5 Years Down

These tiny shifts in your property search could potentially create an additional $400k-$2mil by the time you retire

Here's why;

The property market has changed drastically from what it looked like before. Cooling measures, Consumers' buying behaviour and Connectivity of our country have reshaped the way properties are bought.

My Client Avoided Half A Million Dollar Mistake

One simple property transaction would have made his family a life changing difference

I had a client who based on traditional standards, believed that Freehold, Central Location and being Near MRT was the safest way to invest. What's not to like about these traits?

He was about to put a decade of his savings into this investment property so that his money can finally work for him.

However, after going through our investment framework, he was convinced that the numbers for the development he wanted, did not make sense. I presented 3 other options for him to consider and he went with one of it.

Fast forward 4 years later, his investment Treasure At Tampines appreciated $600k+, from $1.6mil to $2.3mil.

The development he would have bought? RV Altitude. Only $100k during the covid boom, from $1.6m to $1.7m, and it would have barely covered the expenses.

Some of the best performing properties, are NOT located in great locations. They are NOT near the MRT or good schools. They are also NOT Freehold or 999 years. Yet they have been able to deliver amazing profits consistently.

It's easy to say "I should have bought this, I should have bought that." in hindsight after seeing the results.

But using our framework, we were able to spot these opportunities early while they were flying under everyone's radar and capitalise on it.

My name is Ryan Seow from JNA real estate.

After analysing hundreds of developments across the nation, together with my team, we have narrowed down to 3 main factors that influence property prices.

This is not just a theory.

We have applied these strategies and aided over 1000+ clients on their property investments. Achieving an average 19.56% per annum nett returns. We have proudly created a system that is SAFE, CONSISTENT & REPLICABLE.

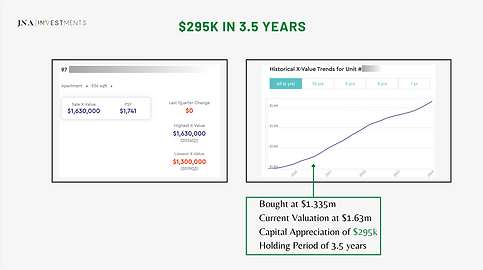

Our Past Clients' Returns

>1000 successful cases